Replace this with your project title

Contents

Replace this with your project title#

Author:Derek Jiang

Course Project, UC Irvine, Math 10, F22

Introduction#

In this project, I will be using different stock prices and volume inside the dataset to predict different gas companies in the US, specifically, from 2015 to 2022. I will also perform some machine learning algorithms to find out which information play the most important role in determining the gas company names. Additionally, I will explore the relationship between these prices during the Covid Pandemic using different graphs and find out some interesting features.

Preparation#

In this section, I will perform basic data cleaning and sorting so I can obtain the data from 2015 to 2022 `

import pandas as pd

import numpy as np

import altair as alt

import seaborn as sns

from sklearn.model_selection import train_test_split

from sklearn.tree import DecisionTreeClassifier

from sklearn.metrics import log_loss

from sklearn.ensemble import RandomForestClassifier

from sklearn.neighbors import KNeighborsClassifier

import matplotlib.pyplot as plt

from sklearn.tree import plot_tree

from pandas.api.types import is_numeric_dtype

alt.data_transformers.enable('default', max_rows=20000)

DataTransformerRegistry.enable('default')

df = pd.read_csv("oil and gas stock prices.csv")

df.isna().any(axis=0)

Date False

Symbol False

Open False

High False

Low False

Close False

Volume False

Currency False

dtype: bool

We performed the above analysis to ensure there is any missing value that needs to be dropped in the dataset. We will also rename column “Symbol” to “Company” for better understanding.

df.rename(columns={"Symbol":"Company"},inplace=True)

df["Year"] = pd.to_datetime(df["Date"]).dt.year

df

| Date | Company | Open | High | Low | Close | Volume | Currency | Year | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | 2000-01-03 | XOM | 39.75 | 40.38 | 38.94 | 39.16 | 13458200 | USD | 2000 |

| 1 | 2000-01-04 | XOM | 38.69 | 39.09 | 38.25 | 38.41 | 14510800 | USD | 2000 |

| 2 | 2000-01-05 | XOM | 39.00 | 40.88 | 38.91 | 40.50 | 17485000 | USD | 2000 |

| 3 | 2000-01-06 | XOM | 40.31 | 42.91 | 40.09 | 42.59 | 19462000 | USD | 2000 |

| 4 | 2000-01-07 | XOM | 42.97 | 43.12 | 42.00 | 42.47 | 16603800 | USD | 2000 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 39196 | 2022-06-06 | SLB | 47.79 | 48.00 | 46.88 | 47.22 | 6696970 | USD | 2022 |

| 39197 | 2022-06-07 | SLB | 47.00 | 49.08 | 46.87 | 48.93 | 14692203 | USD | 2022 |

| 39198 | 2022-06-08 | SLB | 49.00 | 49.83 | 48.08 | 49.57 | 15067131 | USD | 2022 |

| 39199 | 2022-06-09 | SLB | 48.79 | 49.16 | 48.10 | 48.14 | 11447491 | USD | 2022 |

| 39200 | 2022-06-10 | SLB | 47.17 | 47.88 | 46.52 | 47.21 | 11291267 | USD | 2022 |

39201 rows × 9 columns

df_sub = df[df["Year"]>=2015].copy()

df_sub

| Date | Company | Open | High | Low | Close | Volume | Currency | Year | |

|---|---|---|---|---|---|---|---|---|---|

| 3773 | 2015-01-02 | XOM | 92.25 | 93.05 | 91.81 | 92.83 | 10220410 | USD | 2015 |

| 3774 | 2015-01-05 | XOM | 92.10 | 92.40 | 89.50 | 90.29 | 18502380 | USD | 2015 |

| 3775 | 2015-01-06 | XOM | 90.24 | 91.41 | 89.02 | 89.81 | 16670713 | USD | 2015 |

| 3776 | 2015-01-07 | XOM | 90.65 | 91.48 | 90.00 | 90.72 | 13590721 | USD | 2015 |

| 3777 | 2015-01-08 | XOM | 91.25 | 92.27 | 91.00 | 92.23 | 15487496 | USD | 2015 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 39196 | 2022-06-06 | SLB | 47.79 | 48.00 | 46.88 | 47.22 | 6696970 | USD | 2022 |

| 39197 | 2022-06-07 | SLB | 47.00 | 49.08 | 46.87 | 48.93 | 14692203 | USD | 2022 |

| 39198 | 2022-06-08 | SLB | 49.00 | 49.83 | 48.08 | 49.57 | 15067131 | USD | 2022 |

| 39199 | 2022-06-09 | SLB | 48.79 | 49.16 | 48.10 | 48.14 | 11447491 | USD | 2022 |

| 39200 | 2022-06-10 | SLB | 47.17 | 47.88 | 46.52 | 47.21 | 11291267 | USD | 2022 |

14992 rows × 9 columns

df1= df_sub[df_sub["Year"]<2020].copy()

df2= df_sub[df_sub["Year"]>=2020].copy()

df1 and df2 are created for future use and reference.

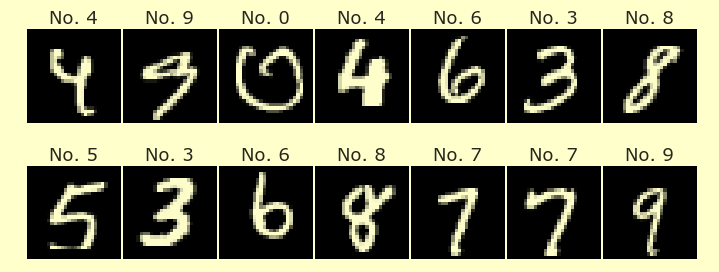

Use DecisionTreeClassifier to Predict#

Here is the process of using DecisionTreeClassifier algorithm to predict the company names.

col = list(c for c in df.columns if is_numeric_dtype(df[c]) and c != "Year")

col

['Open', 'High', 'Low', 'Close', 'Volume']

X = df_sub[col]

y = df_sub["Company"]

X_train,X_test,y_train,y_test = train_test_split(X,y,train_size=0.9,random_state=0)

train_dict={}

test_dict={}

for n in range (10,300,10):

clf = DecisionTreeClassifier(max_leaf_nodes=n, max_depth=10)

clf.fit(X_train,y_train)

c1 = clf.score(X_train,y_train)

train_error = log_loss(y_train,clf.predict_proba(X_train))

train_dict[n]=train_error

c2 = clf.score(X_test,y_test)

test_error = log_loss(y_test,clf.predict_proba(X_test))

test_dict[n]=test_error

print(c1,c2)

0.595612214645716 0.5653333333333334

0.6278535428402016 0.5873333333333334

0.633782982508153 0.5906666666666667

0.6420841980432849 0.592

0.6483101096946339 0.596

0.6537948413874889 0.602

0.6566113252297658 0.5986666666666667

0.6595760450637415 0.5926666666666667

0.6612807589682775 0.5993333333333334

0.6656537207233917 0.604

0.6680996145864215 0.606

0.6723243403498369 0.6053333333333333

0.6752149421879632 0.604

0.676697302104951 0.6046666666666667

0.6785502520011859 0.604

0.6801808479098725 0.6026666666666667

0.6815149718351616 0.604

0.6830714497479988 0.6

0.6847761636525348 0.598

0.6863326415653721 0.598

0.687444411503113 0.5966666666666667

0.6890008894159502 0.5973333333333334

0.6898161873702935 0.5973333333333334

0.6909279573080344 0.598

0.6917432552623777 0.596

0.6927809072042692 0.596

0.6935220871627631 0.5966666666666667

0.6942632671212571 0.596

0.6947820930922027 0.594

After getting the Classifier score, it is actually hard to tell if there is overfitting since testing score lingers between 0.59 and 0.6, and there is no decreasing trend. Therefore, we will use log_loss to decide.

train_dict

{10: 1.0812891154170061,

20: 0.9896847563014075,

30: 0.9382078193185537,

40: 0.9169126035759071,

50: 0.900539187588461,

60: 0.8854427824277942,

70: 0.8747012929417599,

80: 0.8604820619732938,

90: 0.8507974757172453,

100: 0.8406493847623785,

110: 0.8347866058173616,

120: 0.8265968395583174,

130: 0.8200357404579073,

140: 0.8146304014111525,

150: 0.8080306573315309,

160: 0.802870039758331,

170: 0.7983158465323297,

180: 0.7937957863775058,

190: 0.7895915500563069,

200: 0.7854871396502136,

210: 0.7820128042924549,

220: 0.7784909600267844,

230: 0.7748253598046382,

240: 0.771312220805663,

250: 0.7677814789705256,

260: 0.7653361200115115,

270: 0.7610058304789458,

280: 0.7593816733219914,

290: 0.7569965460923642}

test_dict

{10: 1.1328453247775379,

20: 1.074657937019123,

30: 1.1082730713990587,

40: 1.1397578808616415,

50: 1.1730913694552925,

60: 1.1816878047851145,

70: 1.1795811958089182,

80: 1.2200310764935527,

90: 1.3026991467011386,

100: 1.2940687583226973,

110: 1.2880236700166048,

120: 1.373190401980762,

130: 1.3735110697012538,

140: 1.392618143384284,

150: 1.4346567208537615,

160: 1.4579187536755145,

170: 1.4766685169505254,

180: 1.5206393530926234,

190: 1.5653699274293023,

200: 1.6061985841473603,

210: 1.655790868882344,

220: 1.7400863735961696,

230: 1.80452497020446,

240: 1.8640202628351787,

250: 1.9055340245139187,

260: 1.9758916386215357,

270: 2.0159316346527256,

280: 2.0399387705014256,

290: 2.1292321916787276}

From the log_loss result, we can see that after n=70, the testing error starts increasing drastically, so overfitting occurs after n=70.

clf=DecisionTreeClassifier(max_leaf_nodes=70, max_depth=10)

clf.fit(X_train,y_train)

DecisionTreeClassifier(max_depth=10, max_leaf_nodes=70)

clf.score(X_train,y_train)

0.6566113252297658

clf.score(X_test,y_test)

0.5986666666666667

arr = clf.predict(X_train)

fig = plt.figure()

_= plot_tree(clf,

feature_names=clf.feature_names_in_,

class_names=clf.classes_,

filled = True)

Use K-Nearest Neighbors Classifier to Predict#

After using DecisionTreeClassifier, I want to see if there is a better Classifier algorithm that can be applied to this dataset, and I decide to try KNeighbor method with the guidance of additional classnotes

kcl = KNeighborsClassifier(n_neighbors=10)

kcl.fit(X_train,y_train)

KNeighborsClassifier(n_neighbors=10)

kcl.score(X_train,y_train)

0.4293655499555292

def kscore(k):

kcl = KNeighborsClassifier(n_neighbors=k)

kcl.fit(X_train,y_train)

a = kcl.score(X_train,y_train)

b = kcl.score(X_test,y_test)

return (a,b)

[kscore(10),kscore(20),kscore(30),kscore(40)]

[(0.4293655499555292, 0.2826666666666667),

(0.39112066409724283, 0.3006666666666667),

(0.3733323450933887, 0.31133333333333335),

(0.36214052772013045, 0.31533333333333335)]

As we see from the result, the test score is considerably smaller than that of DecisionTreeClassifier, and so the prediction is not as accurate as DecisionTreeClassifier

Using DecisionTreeClassifier on df1#

Now I will use DecisionTreeClassifier on datasets before and after the pandemic occured, and I want to find out two most important features in predicting the companies.

df1

| Date | Company | Open | High | Low | Close | Volume | Currency | Year | |

|---|---|---|---|---|---|---|---|---|---|

| 3773 | 2015-01-02 | XOM | 92.25 | 93.05 | 91.81 | 92.83 | 10220410 | USD | 2015 |

| 3774 | 2015-01-05 | XOM | 92.10 | 92.40 | 89.50 | 90.29 | 18502380 | USD | 2015 |

| 3775 | 2015-01-06 | XOM | 90.24 | 91.41 | 89.02 | 89.81 | 16670713 | USD | 2015 |

| 3776 | 2015-01-07 | XOM | 90.65 | 91.48 | 90.00 | 90.72 | 13590721 | USD | 2015 |

| 3777 | 2015-01-08 | XOM | 91.25 | 92.27 | 91.00 | 92.23 | 15487496 | USD | 2015 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 38580 | 2019-12-24 | SLB | 40.74 | 40.93 | 40.35 | 40.65 | 3860440 | USD | 2019 |

| 38581 | 2019-12-26 | SLB | 40.86 | 40.88 | 39.93 | 40.07 | 7629938 | USD | 2019 |

| 38582 | 2019-12-27 | SLB | 40.13 | 40.38 | 39.83 | 40.00 | 6769230 | USD | 2019 |

| 38583 | 2019-12-30 | SLB | 40.01 | 40.75 | 40.00 | 40.40 | 8159958 | USD | 2019 |

| 38584 | 2019-12-31 | SLB | 40.01 | 40.22 | 39.53 | 40.20 | 10649715 | USD | 2019 |

10064 rows × 9 columns

X1 = df1[col]

y1 = df1["Company"]

X_train, X_test, y_train, y_test = train_test_split(X1,y1,train_size=0.9,random_state=1)

clf1 = DecisionTreeClassifier(max_depth=9)

clf1.fit(X_train,y_train)

DecisionTreeClassifier(max_depth=9)

clf1.score(X_train,y_train)

0.7330241801921166

clf1.score(X_test,y_test)

0.692154915590864

pd.Series(clf1.feature_importances_,index= clf1.feature_names_in_)

Open 0.188328

High 0.278792

Low 0.083583

Close 0.150710

Volume 0.298586

dtype: float64

Using DecisionTreeClassifier on df2#

df2

| Date | Company | Open | High | Low | Close | Volume | Currency | Year | |

|---|---|---|---|---|---|---|---|---|---|

| 5031 | 2020-01-02 | XOM | 70.24 | 71.02 | 70.24 | 70.90 | 12406912 | USD | 2020 |

| 5032 | 2020-01-03 | XOM | 71.34 | 71.37 | 70.16 | 70.33 | 17390568 | USD | 2020 |

| 5033 | 2020-01-06 | XOM | 70.32 | 71.36 | 70.23 | 70.87 | 20082492 | USD | 2020 |

| 5034 | 2020-01-07 | XOM | 70.50 | 70.52 | 69.51 | 70.29 | 17496314 | USD | 2020 |

| 5035 | 2020-01-08 | XOM | 70.11 | 70.28 | 69.17 | 69.23 | 15140731 | USD | 2020 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 39196 | 2022-06-06 | SLB | 47.79 | 48.00 | 46.88 | 47.22 | 6696970 | USD | 2022 |

| 39197 | 2022-06-07 | SLB | 47.00 | 49.08 | 46.87 | 48.93 | 14692203 | USD | 2022 |

| 39198 | 2022-06-08 | SLB | 49.00 | 49.83 | 48.08 | 49.57 | 15067131 | USD | 2022 |

| 39199 | 2022-06-09 | SLB | 48.79 | 49.16 | 48.10 | 48.14 | 11447491 | USD | 2022 |

| 39200 | 2022-06-10 | SLB | 47.17 | 47.88 | 46.52 | 47.21 | 11291267 | USD | 2022 |

4928 rows × 9 columns

X2 = df2[col]

y2 = df2["Company"]

X_train, X_test, y_train, y_test = train_test_split(X2,y2,train_size=0.9,random_state=1)

clf2 = DecisionTreeClassifier(max_depth=5)

clf2.fit(X_train,y_train)

DecisionTreeClassifier(max_depth=5)

clf2.score(X_train,y_train)

0.6426155580608793

clf2.score(X_test,y_test)

0.6085192697768763

pd.Series(clf2.feature_importances_,index= clf2.feature_names_in_)

Open 0.169637

High 0.370563

Low 0.021609

Close 0.000000

Volume 0.438191

dtype: float64

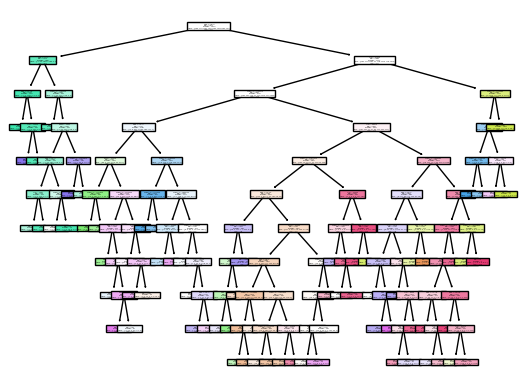

High Price and Volume Relationship#

Now we have seen that High Price and Volume play the two most important roles in predicting the companies. We want to explore the relationship between these two.

c1 = alt.Chart(df1).mark_circle().encode(

x = "High",

y = "Volume",

color = "Company",

tooltip =["Date","High","Volume"],

).properties(

title = "Before Covid"

)

c2 = alt.Chart(df2).mark_circle().encode(

x = "High",

y = "Volume",

color = "Company",

tooltip =["Date","High","Volume"],

).properties(

title = "During Covid"

)

alt.concat(c1,c2)

From the graphs, it is clear that before covid happened, Volume values stay relatively low no matter how High price changes. After covid, Volume drastically rised up, but we cannot exactly explain the relationship yet.

sel = alt.selection_single(fields=["Company"],bind="legend")

c3 = alt.Chart(df2).mark_circle().encode(

x = "High",

y = "Volume",

color = alt.condition(sel,"Company",alt.value("lightgrey")),

opacity =alt.condition(sel,alt.value(1),alt.value(0.1)),

tooltip =["Date","High","Volume"],

).properties(

title = "During Covid"

).add_selection(sel)

c3

By using selection on Company, every company’s data point can be seen in the graph, but it is still not the best visual effect.

c4 = alt.Chart(df2).mark_circle().encode(

x = "High",

y = "Volume",

color = "Year",

tooltip =["Date","High","Volume"],

).properties(

height = 200,

width = 200,

).facet(

column = "Company"

)

c4

Using Facet gives a very clear view of each company’s volume and high price relationship from 2020-2022. The majority of the companeis stock volume were high at low high price at 2020, and as time went on and high price went up, volume stayed roughly the same or gradually decreased.

Now, we want to use the predicted Companies to plot and see the relationship between High Price and Volume in df2

df3 = pd.DataFrame()

df3["Pred"]=clf2.predict(X_test)

h1=[]

h2=[]

h3=[]

h4=[]

h5=[]

h6=[]

h7=[]

for i in X_test.index:

h1.append(df2.loc[i,"Date"])

h2.append(df2.loc[i,"Open"])

h3.append(df2.loc[i,"High"])

h4.append(df2.loc[i,"Low"])

h5.append(df2.loc[i,"Close"])

h6.append(df2.loc[i,"Volume"])

h7.append(df2.loc[i,"Company"])

df3["Date"]=h1

df3["Open"]=h2

df3["High"]=h3

df3["Low"]=h4

df3["Close"]=h5

df3["Volume"]=h6

df3["Company"]=h7

df3

| Pred | Date | Open | High | Low | Close | Volume | Company | |

|---|---|---|---|---|---|---|---|---|

| 0 | MRO | 2020-07-31 | 5.48 | 5.54 | 5.36 | 5.49 | 21249456 | MRO |

| 1 | VLO | 2021-03-08 | 80.00 | 82.60 | 79.54 | 80.56 | 4834572 | VLO |

| 2 | VLO | 2021-11-02 | 78.10 | 79.97 | 77.55 | 77.55 | 4544319 | PSX |

| 3 | XOM | 2021-12-17 | 70.90 | 71.10 | 68.50 | 68.61 | 22942540 | COP |

| 4 | CVX | 2020-08-13 | 89.87 | 91.28 | 89.76 | 89.82 | 7314642 | CVX |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 488 | CVX | 2022-01-28 | 86.16 | 89.20 | 81.98 | 84.25 | 6743044 | PSX |

| 489 | MRO | 2020-06-18 | 19.31 | 20.23 | 19.19 | 20.18 | 15867733 | SLB |

| 490 | XOM | 2022-04-12 | 85.71 | 86.82 | 85.38 | 85.60 | 22020304 | XOM |

| 491 | COP | 2021-08-30 | 60.33 | 60.49 | 58.87 | 58.93 | 6128928 | MPC |

| 492 | MPC | 2021-01-21 | 46.20 | 46.46 | 45.01 | 45.39 | 5204738 | MPC |

493 rows × 8 columns

sel = alt.selection_single(fields=["Pred"])

c5 = alt.Chart(df3).mark_line().encode(

x = "High",

y = "Volume",

color = alt.condition(sel,"Pred",alt.value("lightgrey")),

opacity =alt.condition(sel,alt.value(1),alt.value(0.1)),

tooltip =["Date","High","Volume"],

).properties(

title = "During Covid(Predicted)"

).add_selection(sel)

c6 = alt.Chart(df3).mark_line().encode(

x = "High",

y = "Volume",

color = alt.condition(sel,"Company",alt.value("lightgrey")),

opacity =alt.condition(sel,alt.value(1),alt.value(0.1)),

tooltip =["Date","High","Volume"],

).properties(

title = "During Covid(Original)"

).add_selection(sel)

alt.concat(c5,c6)

Comparing the predicted one with original one, the overall trend still matched well. The accuracy can be calculated as below, which corresponds to the test score. And the highest volume occured on 03/09/2022 on both graphs.

(df3["Pred"]==df3["Company"]).sum()/df3.shape[0]

0.6085192697768763

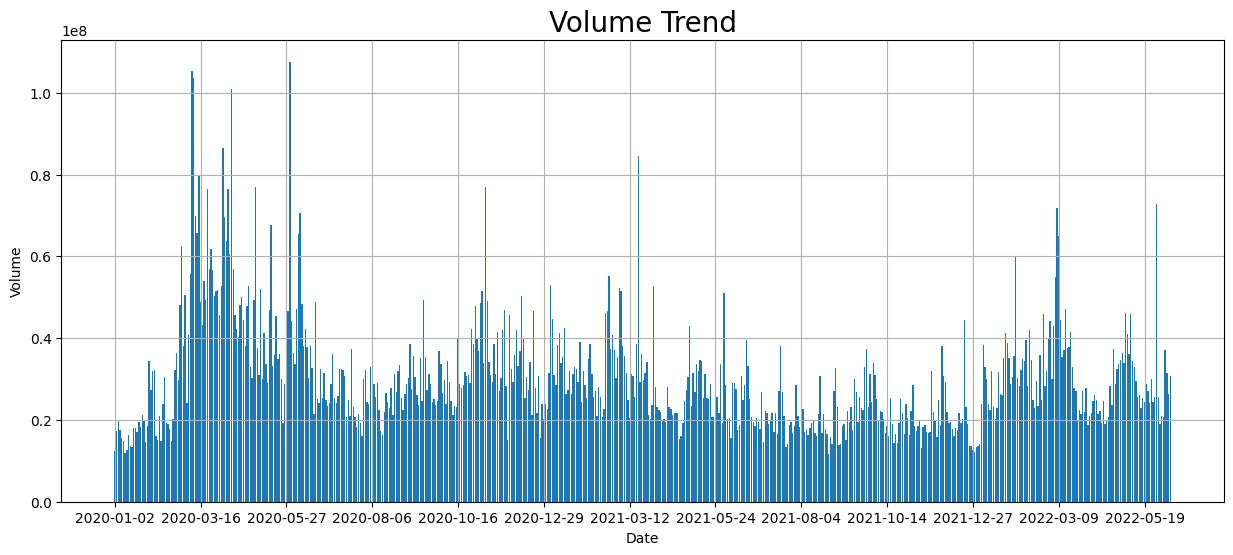

Additional Findings#

After seeing the relationship between Volume and High Price, I want to use another way to show the date on which the highest volume occured and explore which High Price occured the most frequently in df2. To do this, I will include some codes reference learned from Kaggle.

import plotly.graph_objects as go

from plotly.subplots import make_subplots

import plotly.express as px

fig, ax = plt.subplots(figsize = (15, 6))

ax.bar(df2["Date"], df2["Volume"])

ax.xaxis.set_major_locator(plt.MaxNLocator(15))

ax.set_xlabel("Date", fontsize = 10)

ax.set_ylabel("Volume", fontsize = 10)

plt.title('Volume Trend', fontsize = 20)

plt.grid()

plt.show()

The above graph is a volume trend of original df2 data, and we can see that one top volume occured slightly before 03/16/2020, which still corresponds to the above result found in the graph

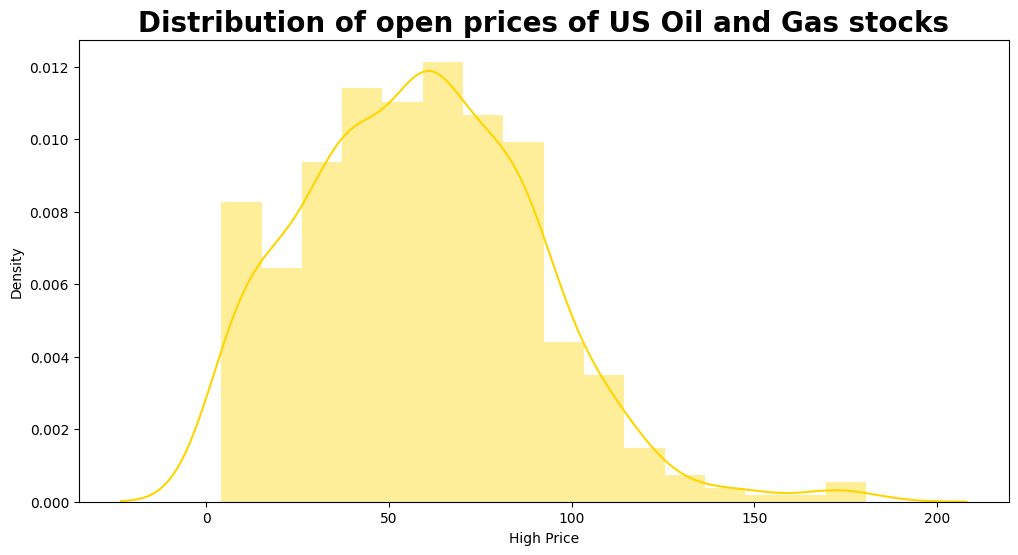

plt.figure(figsize = (12, 6))

sns.distplot(df2["High"], color= "#FFD500")

plt.title("Distribution of open prices of US Oil and Gas stocks", fontweight = "bold", fontsize = 20)

plt.xlabel("High Price", fontsize = 10)

print("Maximum High price of stock ever obtained:", df2["High"].max())

print("Minimum High price of stock ever obtained:", df2["High"].min())

/shared-libs/python3.7/py-core/lib/python3.7/site-packages/ipykernel_launcher.py:2: UserWarning:

`distplot` is a deprecated function and will be removed in seaborn v0.14.0.

Please adapt your code to use either `displot` (a figure-level function with

similar flexibility) or `histplot` (an axes-level function for histograms).

For a guide to updating your code to use the new functions, please see

https://gist.github.com/mwaskom/de44147ed2974457ad6372750bbe5751

Maximum High price of stock ever obtained: 182.4

Minimum High price of stock ever obtained: 3.29

plt.figure(figsize = (12, 6))

sns.distplot(df3["High"], color= "#FFD500")

plt.title("Distribution of open prices of US Oil and Gas stocks", fontweight = "bold", fontsize = 20)

plt.xlabel("High Price", fontsize = 10)

print("Maximum High price of stock ever obtained:", df3["High"].max())

print("Minimum High price of stock ever obtained:", df3["High"].min())

/shared-libs/python3.7/py-core/lib/python3.7/site-packages/ipykernel_launcher.py:2: UserWarning:

`distplot` is a deprecated function and will be removed in seaborn v0.14.0.

Please adapt your code to use either `displot` (a figure-level function with

similar flexibility) or `histplot` (an axes-level function for histograms).

For a guide to updating your code to use the new functions, please see

https://gist.github.com/mwaskom/de44147ed2974457ad6372750bbe5751

Maximum High price of stock ever obtained: 180.64

Minimum High price of stock ever obtained: 4.14

From both distribution graphs, we can see that the High Price that occurs the most stays around 60. The predicted graph does a good job showing this interesting fact.

Summary#

Either summarize what you did, or summarize the results. Maybe 3 sentences.

DecisionTreeClassifier, as a more accurate algorithm compared with K-Nearest Neighbors Classifier, helped me predict the companies using different stock prices and volume. Through exploring the relationship between High Price and Volume, I came to see both overall trend and individual trend of each company. Besides, I found out the date on which the highest volume occurs and the most frequently occured High Price.

References#

Your code above should include references. Here is some additional space for references.

What is the source of your dataset(s)?

This Dataset is from Kaggle: https://www.kaggle.com/datasets/prasertk/oil-and-gas-stock-prices

List any other references that you found helpful.

Reference 1: https://christopherdavisuci.github.io/UCI-Math-10-W22/Week6/Week6-Wednesday.html This is used as a guide to predict companies in the dataset

Reference 2: https://www.kaggle.com/code/mattop/major-us-oil-and-gas-stock-price-eda I borrowed the codes of volume trending and the Distribution of High Price to graph

Submission#

Using the Share button at the top right, enable Comment privileges for anyone with a link to the project. Then submit that link on Canvas.